Credit cards are a great option for building credit. This card is great because there is no annual fee and reports to all three major credit bureaus monthly. You can also apply with little or no credit history. This card comes with the greatest disadvantage: it has a very high interest rate. Make sure to plan ahead before increasing your credit line. Many credit cards are available for those with poor credit.

Credit building

It doesn't take too long to build credit. You can earn points by choosing the right card. This will allow you to build your credit history and have a low credit utilization. If you are a frequent shopper in shops, a shop card may be an option. These cards are excellent for building your credit as they offer rewards and lower rates of interest than other cards. And if you're a college student, you can even get a student credit card. However, when it comes to building your credit, you must be extremely careful because you may wind up paying for things you don't need.

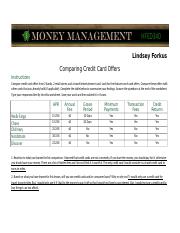

Applying for a credit card

Credit cards allow you to make purchases and establish credit history. However, they should only be used for things that you can't afford to buy in cash or that you need right away. It is important to plan how you will pay your card's monthly balance and what fees are associated with it. A late payment fee of $29 is the national average. An over-limit fee of $39 can prove costly. A debit card is a good option if you're trying to pay off your debt.

Paying on time

It is a great way to improve your credit score. Make timely payments on your credit card. A single late payment could damage your credit score for seven-years. To avoid late payments, ask your family or friends to provide money or use money from your savings account to make your payments. Late payments can also hurt your credit score because credit scoring methods look at your credit limit and the balance on your cards. Keeping your balance to 30 percent or less will help your credit score.

Reduce your credit card limit

Many cases allow you to increase your credit limit. However it is important that you request a limit at minimum twice your current credit limit. If you do not plan to exceed your current credit line, you may end up getting denied, so be sure to think carefully about your spending habits before you request a larger credit line. This can lead to higher rates of interest, higher minimum payments and even higher fees.

Credit card approval

It may be difficult to get approved for a credit line that builds your credit. It can be difficult because of several factors. It is unlikely that you will be approved if your job is not stable. Sometimes you might have to wait several years before your application is approved. If you're patient, you can get approved. These are the steps you need to take to get approved.

Secured Credit Card

Your credit score can be built by using a secured card. A credit card's utilization rate makes up 35% of your overall score, so if you keep your balances under 10% of your limit, your score will increase. Your credit score will improve if you make on-time payments. This is because time is a credit card's greatest ally. A secured credit card will not only help you build your credit score quickly but it can also help you to repair your credit history.