Credit scores are numbers that tell lenders whether you're likely to repay loans such as mortgages or credit cards. It is calculated from information in your credit report.

Your credit score contains information on your debts including how late payments are handled. Your credit report contains information that can help creditors determine if you're trustworthy enough to lend you money and, if so how much.

Your credit report may include information on your loan and payment history going back up to five full years. It includes how much money you owe, including your credit card debt and mortgage loan balance, as well as the amount you have borrowed. It also includes how often you've been late with your loans and credit cards and whether you've had any derogatory items such as collections, bankruptcies or foreclosures.

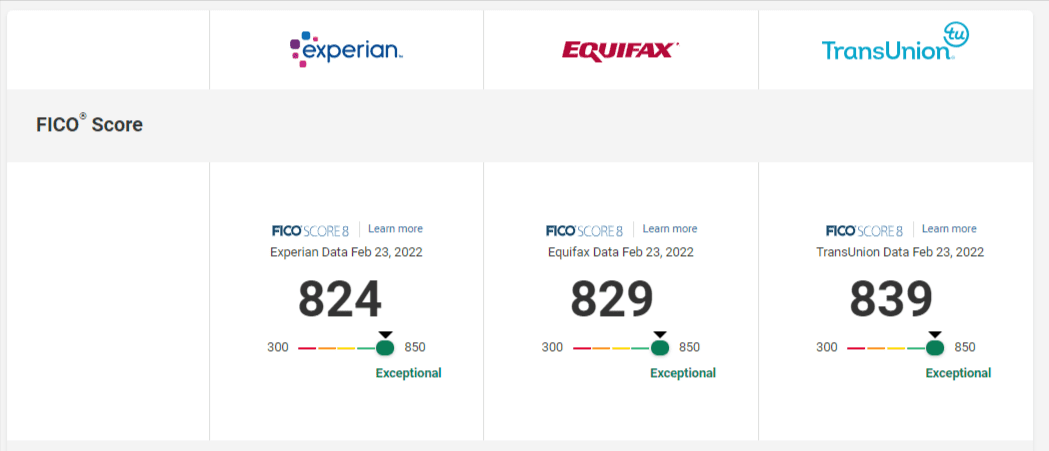

Equifax Experian TransUnion - all three credit bureaus offer credit reports. Each of these bureaus have their own credit scoring model that uses different calculations to determine a score.

The main differences are the factors that go into calculating credit scores. The main difference is how much weight the different factors carry in the score calculation.

Payment history accounts for about 35% in your credit score. Make sure to pay on time, because any late payment will reduce your score.

A third factor that impacts your score is your usage rate. This refers the difference between your available credit limit and how much you owe in credit. You can reduce your utilization rate by paying old bills or increasing your credit limit.

If you have a low credit utilization rate, lenders may be more willing to extend you credit, because they think that you are a responsible borrower who can pay them back on time and in full. A number of factors are important, including the length of your history of credit, the mix of credit you have and your number of credit inquiries.

The credit scoring models of each major credit bureau differ slightly. For example, FICO has more weight in the calculation than VantageScore, which is a newer model that isn't as sensitive to credit utilization.

It is important for those with good credit to be aware that a large gap can exist between the score they receive and the one that they are given by their lender. The discrepancy can be as small at 20 points or even as large as an entire score. It is most likely that the difference in scores is due to errors on your credit report which only appear on one bureau. Regularly checking your credit report is the best way to find any errors.