Capital One Cashback credit card is an excellent choice if you are looking for a card with a great reward program as well as a low interest rate. It offers 1.5% cash back on all purchases and comes with a $200 welcome bonus. It does not have an annual fee or foreign transaction charge. For 15 months, you can enjoy a zero intro APR on purchases as well as balance transfers.

Capital One Savor Cash Rewards

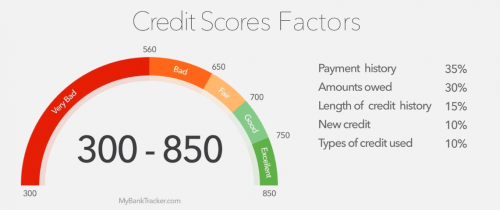

Capital One Savor Credit Card Rewards is an excellent option for consumers who spend lots of money on entertainment or dining. This card allows you to earn unlimited 4% cashback when you make these purchases. However, to get the most benefits, you need to spend a minimum of $800 per month in these categories. To qualify for this card, you should have a credit score between 660 and 850.

Capital One Savor cards offer a generous cashback rate of 4% for everyday purchases. However, it is less generous than some other options. To get cash back, you must spend at the least $3,000 within three consecutive months. However, other cards only allow for a minimum $1,000. The card comes with additional bonus categories to help you get even more out your spending.

Capital One Venture Reward

The Capital One Venture Rewards credit card is the best choice for people who want to earn travel rewards fast. This credit card offers two miles per dollar spent and you have unlimited earning potential. Your miles won't expire so you can continue earning miles as long you have the card. Spend $4,000 to earn 75,000 miles in the first three month.

You can also transfer rewards from the Capital One Venture Rewards credit cards to other cards and travel providers. If you have enough Capital One Venture Miles you can use these miles for any airline. You can also transfer your rewards to other Capital One transfer partners, such as Cathay Pacific and Aeromexico.

Capital One Spark Classic for Business

Capital One Spark Classic for Business creditcard provides a modest 1% cash-back reward rate for all transactions. This card offers a modest 1% cash back reward rate, which is among the best available. However, there are many other benefits. First, there are no annual fees. It also offers periodic spending reports and downloadable purchase records. Additionally, the card is eligible for 5% discounts at select merchants

The Capital One Spark Classic for Business credit card offers special travel perks as well as access to exclusive events. It also offers $0 fraud liability and purchase security. You can also get an extended warranty for eligible purchases which doubles your manufacturer's warranty.

Capital One QuicksilverOne Cash Rewards

Capital One QuicksilverOne Gold Rewards Credit Card offers excellent cash back and great Capital One benefits. It provides unlimited 1.5% cashback for all purchases and an additional of 5% on Capital One Travel. This is a great credit-building card because it offers generous cash back rates and fast rewards. It also doesn’t expire, making it easy to accumulate significant cash.

The Capital One QuicksilverOne Rewards Credit Card comes with a $39 Annual Fee. This makes the card affordable for people with low credit scores. The card's unlimited 1.5% cash back benefit can help people build positive credit scores and establish a payment history. While there are some cons to this card, it is an excellent option for those who want credit building and rewards.