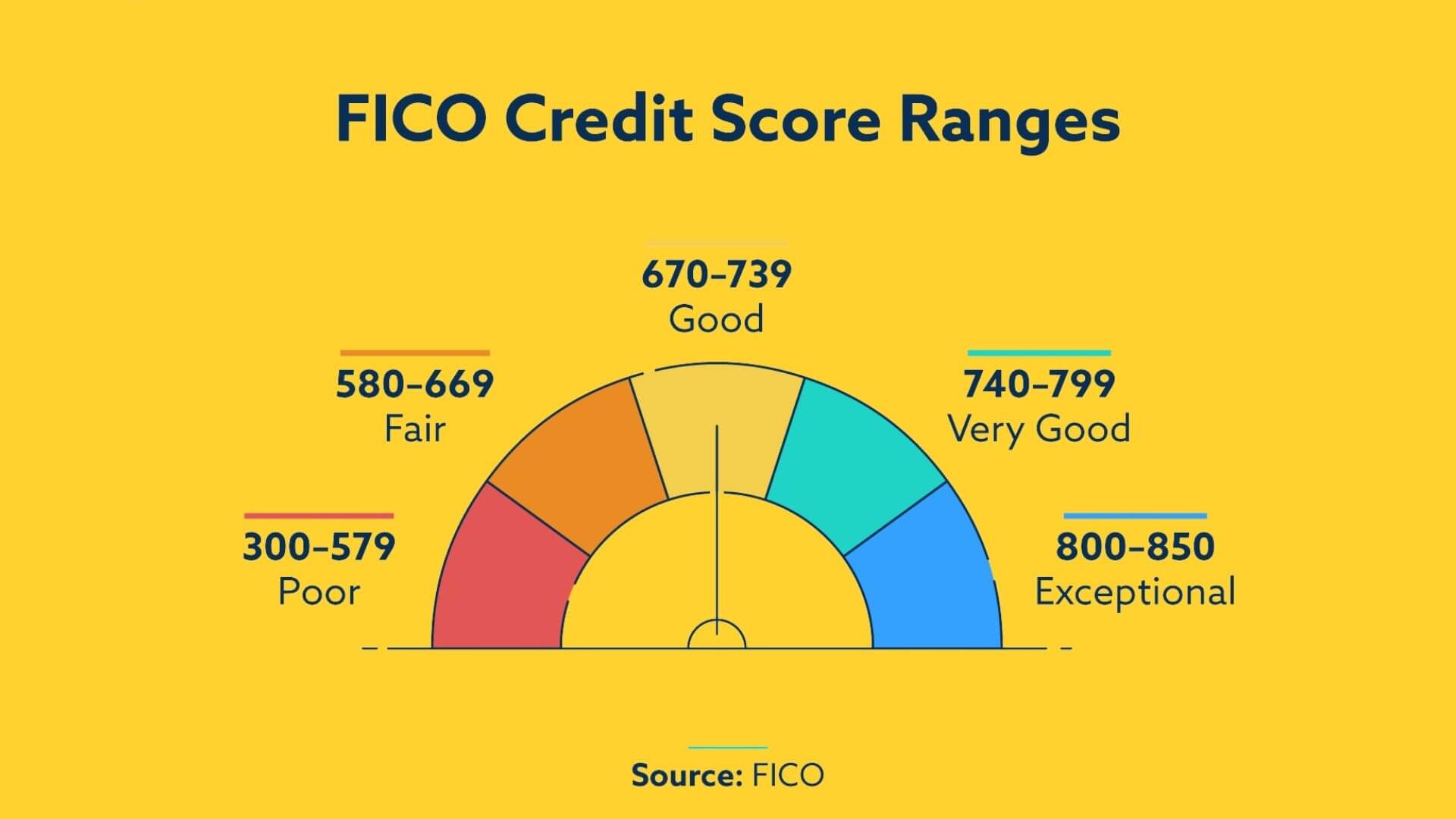

You should look into a rewards card if you are considering a credit card. Rewards credit cards offer added benefits and earnings potential. These cards are especially beneficial if large purchases are made on your card. To ensure you get approved for one, it's important to know about your credit history.

Capital One Savor Rewards card

Capital One Savor offers high rewards rates for dining and entertainment with its rewards card. After you spend $3,000 in the first three months, you will receive a $300 cash reward. The card has no foreign transaction fees, and offers a variety of benefits including 24-hour emergency help and travel accident insurance.

For people with good credit, the Capital One Savor rewards cards is a great option. It provides unlimited 4% cashback on dining out and entertainment purchases. The card offers 3% cash back on groceries, streaming services, and other purchases. You will also enjoy no foreign transaction fees, strong shopping protections, and an easy redemption process.

Citi Premier Card

Citi Premier Card, a multi-purpose rewards card, allows you to redeem points towards merchandise, gift cards and travel. The rewards rate of the Citi Premier Card is excellent, at three points per $1 spent on most categories. You also get a $100 annual hotel benefit and no foreign transaction fees.

The card's perks are relatively modest, though. It does not provide lounge access or priority boarding. But, the card provides other travel benefits such as access the Mastercard Luxury Hotels and Resorts Program. Cardholders also get $5 credits for every three Lyft ride they take. The card comes with three months free DashPass membership. This allows members to save money on cab fare. ShopRunner membership is another benefit, worth $79, that offers two-day free shipping at hundreds.

Chase Sapphire Reserve

Chase Sapphire Reserve is a premium credit card that offers many perks. First, you can transfer your points to participating airlines. This includes airlines such as Emirates Skywards and Air Canada Aeroplan. Redeem your points to purchase gift cards or merchandise. You can also transfer points to other loyalty programmes with this card's unique feature. Chase Sapphire Reserve has a 1:1 transfer ratio to many loyalty programs. You can also transfer points to selected partner airlines up to 1.5 cents a point.

Another notable feature of this credit card is that it has a higher earning structure than its Sapphire Preferred counterpart. Chase Sapphire Reserve offers a higher earning structure than its Sapphire Preferred counterpart. You get more points for every dollar you spend. This is in addition to the fact that you can transfer your points into a variety travel partners and earn elite credits.

American Express cashback card

American Express cash back cards are a great way for you to earn rewards on everyday purchases. Blue Cash Everyday(r), while it comes with an annual $95 fee, earns more than 1% of all purchases in cashback rewards. You can earn up to $250 cash back per six months if you use your credit card frequently. This card is ideal for those with 700+ credit who use it for grocery and gas purchases.

Cash back credit cards are popular because they offer tangible benefits. If you use your card at restaurants, you'll earn cash back that can be deposited into your account. This could make them more attractive than other rewards cards such as gas credit or travel rewards. Cash back cards may not be the same for everyone. Some offer cash back on all purchases, while others offer higher rates on some categories. You can take advantage of a higher rate of cash back by rotating your highest-earning categories each quarter.