It is possible to wonder how you can maintain a healthy balance on your credit cards. This article will explain how to properly manage your credit cards' utilization ratio. These tips will show you how to avoid paying fees, keep track on your balances, avoid late payments and avoid penalties. Continue reading to improve your credit score, and to learn how to keep track on multiple credit cards. Remember to pay your balances on-time. It is easy! The benefits are numerous!

Credit card utilization ratio

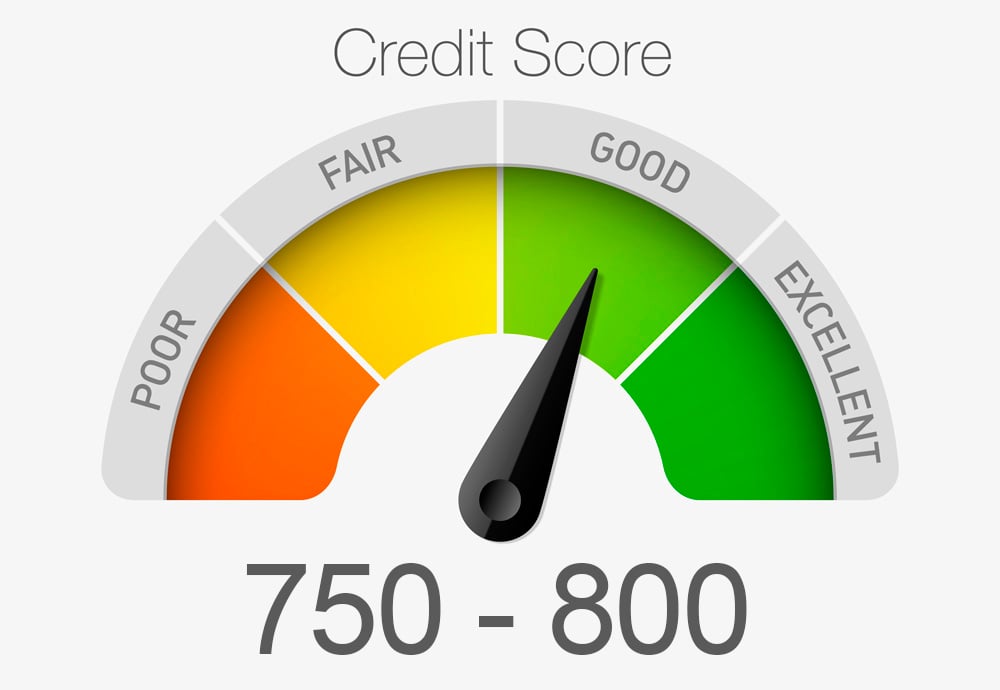

Reduce your credit card utilization ratio to improve your credit score. This is based on the current balances and credit limits on your credit reports. The credit card issuers report this information to the credit bureaus, so it is unlikely that you will have a zero balance. You will see this amount on your latest statement. Your goal is to pay your balance off in full every billing cycle. If you can't pay your balance in full each billing cycle, then pay it off completely.

Keep track of multiple credit card accounts

You need to track the credit cards that you have. It is important to monitor your spending and payment due dates to avoid credit card debt and high interest rates. You should also make a habit of paying off your credit card balances in full. This will reflect in your credit score. If you are able to use your credit cards effectively, it is possible to keep track of multiple credit card accounts and your credit score.

Repayment of outstanding balances on time

While credit card balances can vary from person to person, paying them off on time is essential to boost your credit score. You should be aware that credit cards come with different grace periods and billing cycles so you know when to make your payment. You can set up reminders and automatic payments to remind you to repay your balance. Avoid large purchases using your credit card because they can raise credit utilization.

Avoiding fees

You need to know how to avoid paying fees when using credit cards. Annual fees, foreign transaction fees, late payment fees, and cash advance charges are just some of the many hidden fees you'll encounter with credit cards. While these costs are often minimal, they can add up to hundreds of dollars each year. To avoid these fees, you can change the products or usage habits associated with your cards. You can create automatic payments each month for your minimum, full or customized amount.

Low credit utilization

For your financial health, it is important to keep your credit utilization ratio and credit score low. Calculation of utilization is based on the balances in your monthly statements. A great way to lower credit utilization and maintain your credit score is to pay off large purchases quickly. WalletHub offers a free online credit assessment. To reduce your total amount of debt, it's wise to make more than one payment per month.