There are some myths about credit scores. One myth is that closing a credit line with high interest rates will lower your credit score. Another is that parking tickets or fines are not included on your credit reports. You should also be aware that co-signing credit card applications will not harm your credit score.

Credit score can be negatively affected by closing a credit card that has a high interest rate.

You shouldn't close your credit line with high interest rates. Here are some steps to prevent your account from being closed. Paying off your balance in full is the best way to close your account. You can also cancel any recurring fees if you wish. Once you've completed this, contact your card issuer and verify that your balance is at zero before closing the account. It's a good idea also to pay attention to your three credit reports.

You can have a negative impact on your credit score by closing a card with a high rate of interest. As you may already know, the longer you have active credit, the higher your credit score will be. Because lenders want to see that credit management has been done responsibly, this is why it's important for you to have active credit. But, closing a credit account that you have held for several years can significantly reduce your credit score.

Parking tickets and fines are not recorded on your credit reports

Even though parking tickets or fines don’t appear on your credit report, it can still impact your driving record. Scumbags may find it difficult to get along with the state and city governments, who have a long memory. You could lose your driving record or have your car impounded if you don't pay the ticket.

Parking tickets and fines can also impact your credit score. Car insurance companies require drivers to have a clean driving record. These records record a driver's driving history, including accidents and roadside incidents. They are a historical retelling of the time spent behind the wheel.

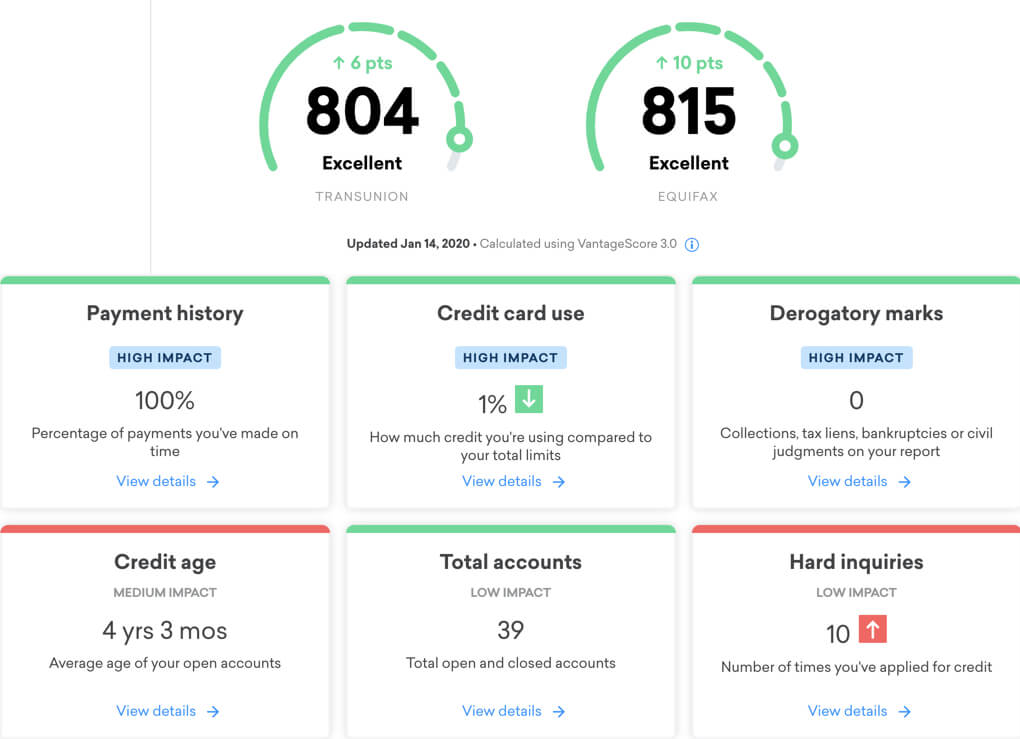

A lot of credit cards can lower the average age for your accounts

One way to reduce the average age of your accounts is to open up a lot of credit cards. If you plan to use your credit cards over a period of time, this can be fine. However, it can cause credit scores to drop. Avoid this by sticking to just one or two cards. Closed accounts are another option to reduce your account's average age. Some lenders will allow you to close your accounts automatically after you pay off a debt.

Do not rush to open another credit card if your credit limit is nearing its maximum. Although you may see a short-term benefit from opening a new account, it won’t solve the long-term issues like excessive spending and undersaving. Instead, be focused on maintaining balance and being consistent in your payments.

Co-signing is not a factor in your credit score

While it might seem like a good idea, co-signing for a loan is a risky practice. Not only is it risky from a financial standpoint, but it can also lead to personal problems. If you don't want to take on this risk, it is worth seeking professional advice before your loved one borrows money.

While you don't have to cosign for every loan, it is a great way to help people with poor or no credit. You will have a better chance of getting favorable interest rates and fees if you are able to do so. Before you sign, however, it is important to understand exactly what you are required to do.