It's crucial to understand your credit score and what you can improve it. Start by getting a free copy of your credit reports. You can then check your credit score regularly to monitor its progress. And you should always be aware if your credit score changes.

Request a Free Credit Report

Visit the official website to get your free credit report. You will need to enter some personal information, such as your name and address, current address, date of birth, social security number, and SSN. Some companies may also request additional information. Once you have provided all the required information, you can start the process of requesting your credit report.

Your credit report may take up to a few days to arrive. It is best to get a copy of your credit reports as soon as possible. However, it is important to be patient. Although it may take up to 15 days to process your request, you can expect your report to arrive within that time.

Ask for a duplicate of your credit reports

To get an overview of the factors that impact your credit score, request a copy. This information could be helpful when you apply for a loan or an insurance policy. For example, if you have a bad credit history, you might have been declined by a lender. You can find information about any inquiries you have made over the past two year on your credit reports.

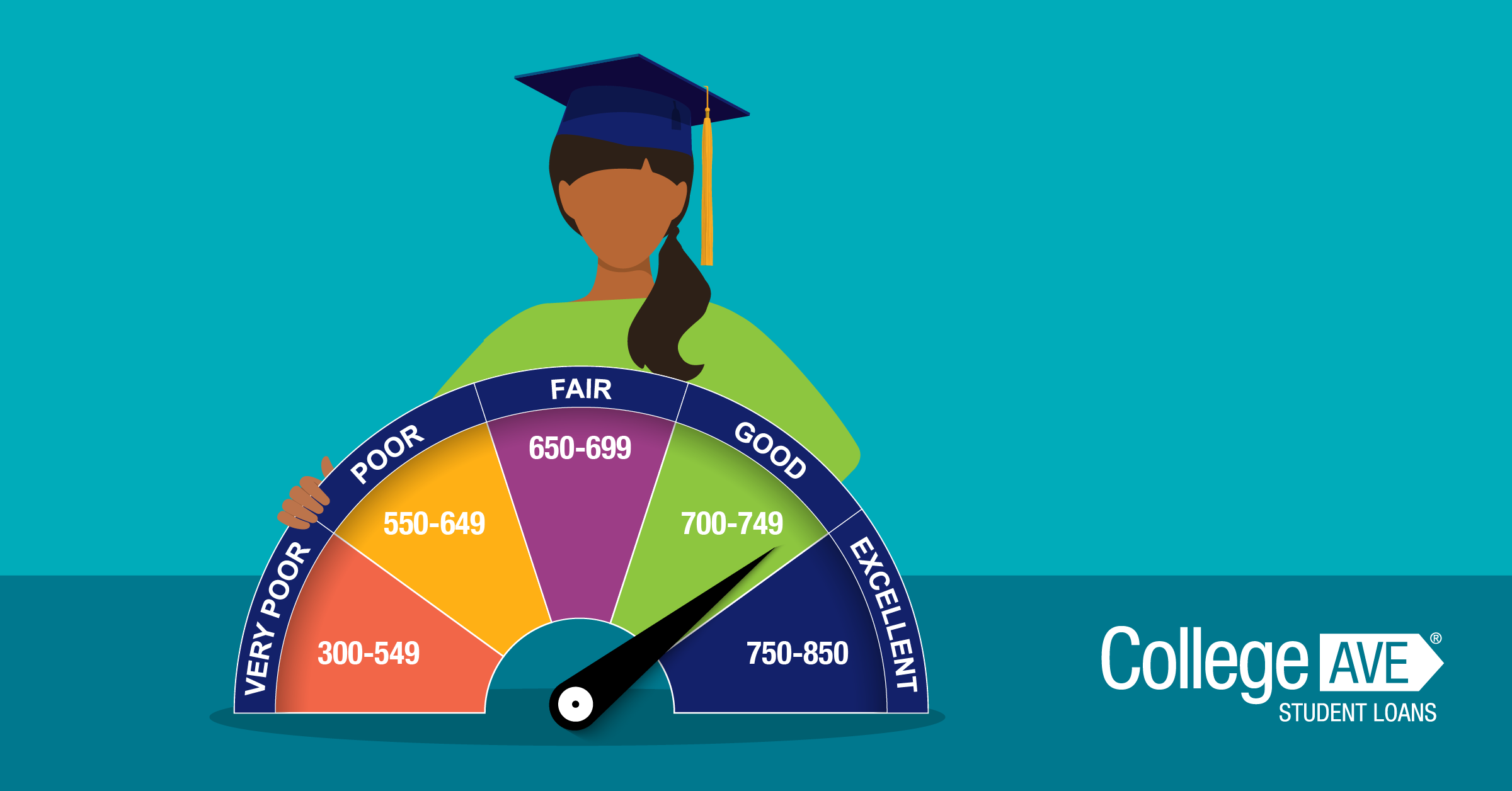

Credit score is a number of three-digit numbers that are calculated using data from your credit reports. The range can be between 300 and 850. Each bureau uses a different formula in determining your credit score. It is a reflection on how likely you will repay a loan.

Your credit score should be checked regularly

If you're in good financial health, you know that it is crucial to regularly check your credit score. NerdWallet's study found that nearly two-thirds don't review their credit reports each year. You can identify fraud and errors in your credit reports and protect yourself against identity theft by keeping track. Information about your past addresses and employers is included in your credit report.

You can avoid identity theft by checking your credit score often. When someone pretends to be another person, they steal vital information such as social security numbers. They use this information to make various financial transactions with the victim's identity. A high credit score will help you avoid potential theft and protect your financial future.

Good credit scores are important

In today's financial world, a high credit score can open doors to many financial opportunities. A high credit score will help you get lower interest loans rates. Your job prospects can also be affected by your credit score. If you have a high credit rating, it is more likely that you will be hired by an excellent company.

A good credit score is important when renting an apartment or buying a house. This is because landlords and lenders will be able see your debt history and decide if you're a suitable risk. A good score and timely payments will help you get a better rate on your mortgage.