A debit card is a great way to build your credit. However, there are also disadvantages. Discover the advantages and disadvantages of using a debit card to build your credit. Also, learn how it can impact credit scores. Using a debit card to build credit is an important part of a healthy financial life. While you won't see much of an impact on your credit score, it is still worth considering.

Use a debit card for credit building

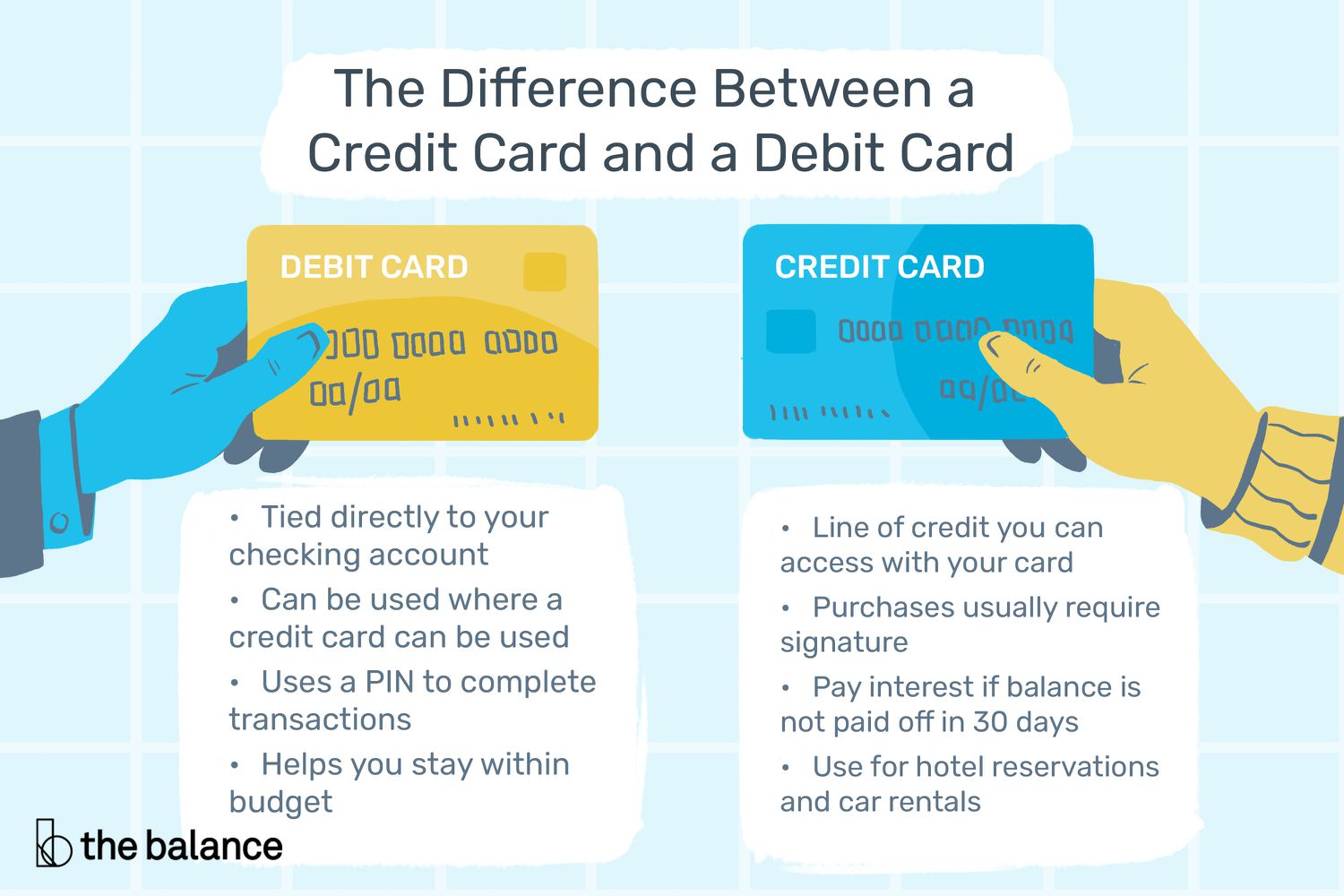

A debit card can be used to build credit. This is an excellent option for people who are having trouble building credit. Debit cards don't charge interest, unlike credit cards. You can still spend without worrying about your credit rating. A debit card is also easier to keep to a budget.

A debit card has the greatest benefit: it doesn't affect your credit history. This is especially true when you're trying to build credit quickly. While conventional debit cards won't improve your credit score, a fully-equipped card can help you reach the financial stability you need to succeed. You will be able to debit your account and charge your purchases instead of using your card. This will enable you to take full control of your finances.

There are also fewer fees for debit cards than credit cards. You don't have to worry about paying steep interest on purchases, and there are no ATM fees. Some banks will even let you enter your PIN to save money on credit card processing.

The cons of using a debit card to build credit

The best thing about a debit card? You can use it to make payment without having cash. This makes it simpler to pay for purchases if you don’t have enough cash. Another advantage is that you will never be overwhelmed by a big bill at the start of your next billing cycle. A debit card can be a great way to build credit.

A debit card works differently to a credit or debit card because the amount you spend does not affect your credit score. It won't impact your credit score. This means you can use your debit card to build credit history and get the best rates.

Use a debit card to increase your credit score

A debit card is a good option for those who don’t already have a bank account and wish to build their credit. These cards limit you spending to what your credit will allow. This is bad for your credit score as interest can build up over time.

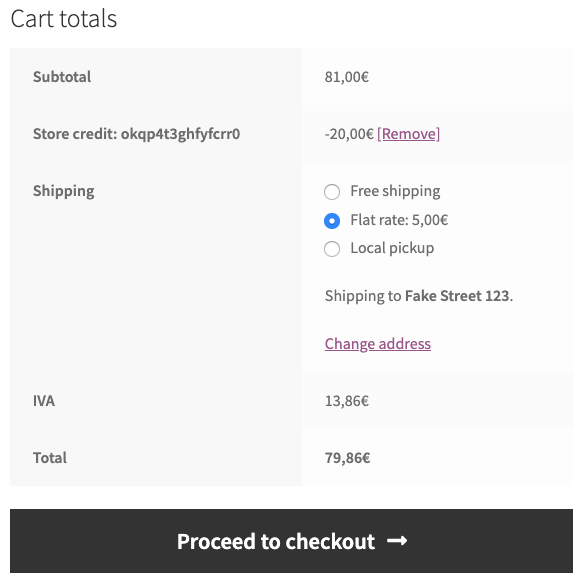

Your credit card purchases are reported to Experian, TransUnion and Equifax. These bureaus look at your credit report to determine how creditworthy you are. Many banks offer FICO scores free of charge to customers with every billing cycle. If you use a debit card to build up your credit, transactions are not visible on your credit reports.

While building credit with a debitcard can improve your financial life, it won't increase your credit score. A credit card shows the lender that you are responsible, and a debit card shows that you can pay back debts. However, if you use a debit card to build your credit, the bank could close your account or report you to ChexSystems, which is an alternative credit reporting system.